The loans you make get paid back at an incredible repayment rate of 98.85% (as of this post date). To put this into comparison, the US Department of Education estimates that less than 87% of student loans get repaid in the United States. “Two out of five student loan borrowers – or 41%- are delinquent at some point in the first five years after entering repayment.” (asa.org) This should bring comfort to the minds of those who worry about giving money internationally and not receiving repayment.

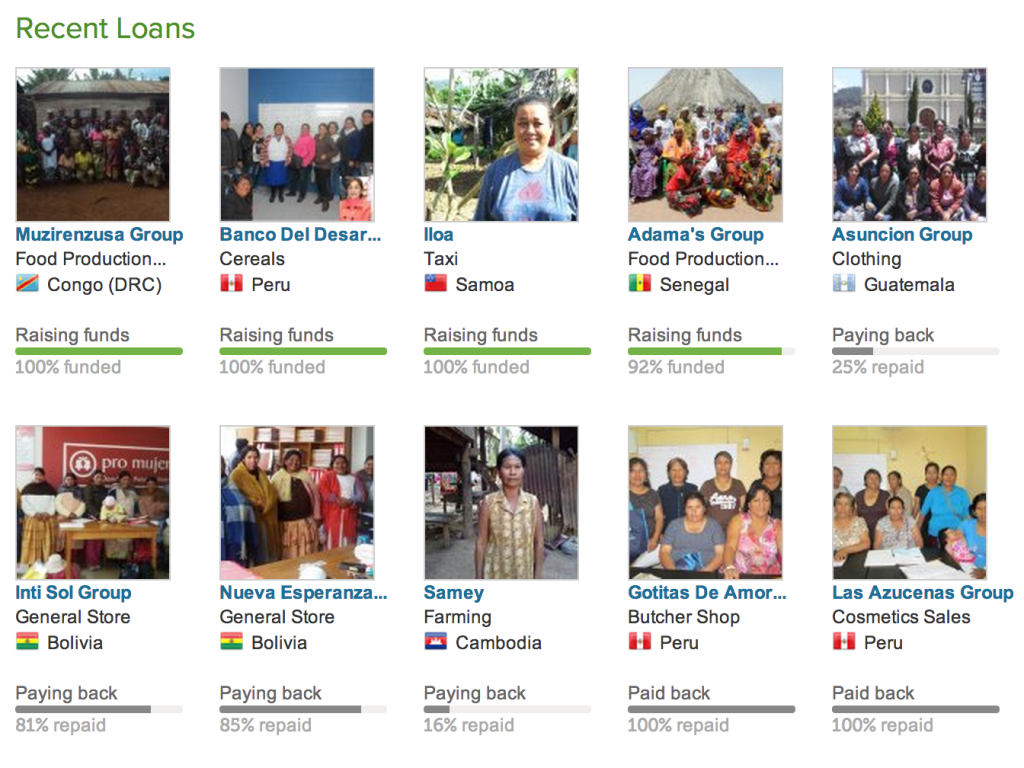

Now, the way Kiva works is that you transfer money to your Kiva account, then select businesses from countries all around the world using a simple loan selection process. You are able to view photos of the actual people you are lending to, as well as learn about what they intend to use the money for and how much they are asking. In general, each loan is about $25, so you can mitigate risk alongside others who are giving to the same borrower.

The microloan borrower, after receiving the funds, continues to grow their business and make repayments as they go. Little by little, your loans get repaid back — and here’s the kicker — interest free.

Your loans are truly gifts, because you’re not giving to receive. You’re giving to change the world.

In my experience, the loans are repaid promptly and in full, allowing you to relend the credits to new business owners. This allows your original donations to be re-used, over and over, to fund entrepreneurs in small towns and villages all over the world.

The reporting features that Kiva provide are fascinating. They let you get a snapshot of all the donations you’ve made, as well as what types of industries and countries you have supported.

Kiva, as an organization, operates off of donations that you can make using the repayment loans or additional funds you deposit. They don’t take a fee off of what you donate, so 100% of the loan goes to the micro-loan borrower (less any fees the borrower may pay to their local micro-loan organization, who manages and reports on the progress of the business and loan repayment). So you can choose whether to give 100% of your loan to the borrower, or let part of it serve as a donation to support Kiva as an organization.

So what are you doing with your extra cash? More Starbucks, clothes and dinner’s out? Consider microlending as a new form of entertainment. Make a Kiva Loan today!